|

[VIEWED 118463

TIMES]

|

SAVE! for ease of future access.

|

|

|

|

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 04-25-09 3:58

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Here are some of the stocks that showed up on my buy scan. We may have seen the low but it is possible that we see one more sell-off to wash the weak hands. Currently I am doing intraday trades from the long side only. If S&P closes below 800, I'll stay on the sidelines.

If the market goes up from here these stocks should easily double. The holding period is at least 1 year (if profitable). Put these stocks on your watch list and when you see a pattern as described on the follwing link, you can buy. ALWAYS use stop losses. Stops should be somewhere between the low of the cup and low of the handle. This pattern is described in detail in William O Neil's book, "How to make money in stocks". You can probably get it from your local library or buy one...it is worth the money. If you are patient and wait for the right time you should do pretty good at the end.

If you find other stocks that have a similar pattern, please post it here.

http://www.chartpattern.com/cup_handle.html

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns:cup_with_handle_cont

I won't have time to post everyday but will try to answer any questions on weekends.

Thanks for all the emails.

Happy Investing.

Scroll down for the list. Not sure why there is such a huge blank space.

Rank |

Symbol |

Company Name |

Last Price |

1 |

GHM |

Graham Corp |

12.98 |

2 |

AAPL |

Apple Inc |

123.9 |

3 |

ANR |

Alpha Natural Resources Inc |

19.7 |

4 |

GOOG |

Google Inc |

389.49 |

5 |

HXM |

Desarrollaxdora Homex DR |

21.86 |

6 |

HP |

Helmerich & Payne Inc |

32.76 |

7 |

NOV |

National Oilwell Varco Inc |

31.5 |

8 |

PCLN |

Priceline.Com Inc |

96.16 |

9 |

HANS |

Hansen Natural Corp |

39.89 |

10 |

NBL |

Noble Energy Inc |

60.69 |

11 |

CMI |

Cummins Inc |

33.38 |

12 |

DRQ |

Dril-Quip Inc |

34.1 |

13 |

BWLD |

Buffalo Wild Wings Inc |

41.84 |

14 |

SPAR |

Spartan Motors Inc |

6.93 |

15 |

HITT |

Hittite Microwave Corp |

37.07 |

16 |

VSEA |

Varian Semiconductor Equipment Associates Inc |

23.91 |

17 |

AMX |

America Movil ADR Rep 20 Series L Ord Shs |

33 |

18 |

ENG |

ENGlobal Corp |

6.19 |

19 |

MT |

ArcelorMittal ADR |

27.23 |

20 |

AMTD |

TD Ameritrade Holding Corp |

16 |

21 |

DNR |

Denbury Resources Inc |

16.48 |

22 |

OII |

Oceaneering International Inc |

43.94 |

23 |

DLB |

Dolby Laboratories Inc |

36.81 |

24 |

TNB |

Thomas & Betts Corp |

28.01 |

25 |

SNDA |

Shanda Interactive Entertainment Ltd |

48.03 |

26 |

SOHU |

Sohu.com Inc |

52.43 |

27 |

WAB |

Wabtec Corp |

38.12 |

28 |

GCO |

Genesco Inc |

21.76 |

29 |

FTI |

FMC Technologies Inc |

36.13 |

30 |

VMI |

Valmont Industries Inc |

62.2 |

31 |

NTES |

Netease.com Inc |

30.91 |

32 |

AIT |

Applied Industrial Technologies Inc |

22.09 |

33 |

WBD |

Wimm-Bill-Dann OAO |

44.31 |

34 |

WDC |

Western Digital Corp |

21.16 |

35 |

MCRS |

Micros Systems Inc |

20.61 |

36 |

CERN |

Cerner Corp |

47.42 |

37 |

GYMB |

Gymboree Corp |

33.43 |

38 |

RSTI |

Rofin-Sinar Technologies Inc |

19.29 |

39 |

BRY |

Berry Petroleum Co |

16.92 |

40 |

CNQ |

Canadian Natural Resources Ltd |

48.94 |

41 |

WIT |

Wipro Ltd |

9.12 |

42 |

CHRW |

CH Robinson Worldwide Inc |

53.35 |

43 |

BMI |

Badger Meter Inc |

37.69 |

44 |

CEO |

CNOOC ADR representing 100 Class H Shares |

115.55 |

45 |

BKE |

Buckle Inc |

35.2 |

46 |

LNN |

Lindsay Corp |

38.32 |

47 |

DAR |

Darling International Inc |

6.08 |

48 |

CTRN |

Citi Trends Inc |

23.77 |

49 |

MCHP |

Microchip Technology Inc |

22.25 |

50 |

SNX |

SYNNEX Corp |

19.39 |

51 |

ARO |

Aeropostale Inc |

32.89 |

52 |

TRAD |

TradeStation Group Inc |

7.79 |

53 |

SCHW |

Charles Schwab Corp |

17.84 |

54 |

NKE |

NIKE Inc |

54.73 |

Last edited: 25-Apr-09 04:01 PM

Last edited: 25-Apr-09 04:06 PM

|

| |

|

|

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 05-04-09 10:58

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

If someone has AGYS and the price is below 7.75 around 3est. you might want to sell the stock and take the loss/gain. This is a failed break-out and will likely go below 5.

|

| |

|

|

A1B2

Please log in to subscribe to A1B2's postings.

Posted on 05-04-09 12:08

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Thanks emini, I bought AGYS @7.62 . I will follow your suggestion. Also bought MTL@ 6.60 Thanks for the update

|

| |

|

|

Riten

Please log in to subscribe to Riten's postings.

Posted on 05-04-09 12:30

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

eminitrader, Thanks for offering to teach us how to fish :-) (now can you bring the beer as well, just kidding) and in that vein, can you please define the terms:

- Trigger Price

- Max Buy Price

- Stop

I kinda understand already, but want to make sure. I apologize if you have already explained this earlier. If there are other terms you use frequently, please provide the definitions for those as well. A lazy newbie.

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 05-04-09 12:54

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Welcome Riten, I was wondering where you were....... Trigger Price is the price that the stock has to get to before you buy it. We want to buy the stock as it is moving up. Max buy price is te maximum amount that you pay for a stock. For example, if the stock gaps up in the morning and it is above your max buy price..you just let it go. Stop is where we will get out if the stock starts moving down after we buy it. The stop is wide here and we will adjust it accordingly every week. It seems every stock hit the trigger except for GLNG and FEED. Many are already above the max buy price.

|

| |

|

|

purush

Please log in to subscribe to purush's postings.

Posted on 05-04-09 1:46

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Thanks for your update. It has been helpful. However, I feel like I have become too dependent on you. Way to go for me to learn these things. As per you, I sold that AGYS - lost only the transaction fee not on the real share price. Market research on each of these stocks is really a time consuming task, I know you're putting a lot of time on this. In addition to look at the chart for prices, I think we should be analyzing the financial statements too I guess. Thanks for your help. It is really appreciated.

|

| |

|

|

tintotopi

Please log in to subscribe to tintotopi's postings.

Posted on 05-04-09 1:55

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

i am a rookie when it comes to stock.. can you explain buy stop etc. here.. Thanks,

|

| |

|

|

AAAA

Please log in to subscribe to AAAA's postings.

Posted on 05-04-09 2:10

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

this thread has been really helpful. thanks eminitrader.

|

| |

|

|

purush

Please log in to subscribe to purush's postings.

Posted on 05-04-09 2:22

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Tintotopi, take you time to read previous postings from Eminitrader before asking a question. He has explained it in his previous posting not to far before. Hope this helps.

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 05-04-09 2:25

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

|

|

| |

|

|

cutenepali

Please log in to subscribe to cutenepali's postings.

Posted on 05-04-09 2:27

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I'm out of BAS ..the volume doesn't look good for this one.. CX & MTL is still going strong. Emini, What are your thoughts about the overall market in coming days..I feel like stress test result is a joke and seems like the momentum is too strong right now to see any decent pullback!

|

| |

|

|

Riten

Please log in to subscribe to Riten's postings.

Posted on 05-04-09 3:50

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Eminitrader, Thanks for the explanation. Your picks are very interesting. I will take your suggestion as starting point, do my own dysfunctional research, and do the needful. I surely do appreciate your input. So friends, Recently (before I stumbled upon this thread) I bought these stocks:

- Citi

- Bank of America

- Wells Fargo

- Rexx Energy

- National Oilwell Varco

Glad to say that I am almost 16% up. Except for Citi stock, which is currently below my purchase price - though it is steadily climbing today - all the others are making money for me. I am seeking stocks like Rexx, which are so beaten down that their price is in single digits but the company holds a promise and most likely triple, quadruple or more the current stock price in a matter of year or two when the economy makes the turn. Any ideas?

|

| |

|

|

fortunefaded

Please log in to subscribe to fortunefaded's postings.

Posted on 05-04-09 4:13

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Riten, I was looking into REXX. It jumped 16% today and I still think it has some juice left for it to go higher. I am posting the daily chart below and it looks to me like a Cup and Handle pattern that Emini was talking about. Correct me if I am wrong.... And you can also look at this chart as a possible Inverted Head and Shoulders, which is a bullish reversal pattern. Read more about it here: http://www.incrediblecharts.com/technical/head_and_shoulders.php

Last edited: 04-May-09 04:20 PM

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 05-04-09 4:27

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

FF, Very nicely done. That was a C&H formation. Hope you are still holding FEED. We could see $6 this week.

|

| |

|

|

lato_boy

Please log in to subscribe to lato_boy's postings.

Posted on 05-04-09 5:25

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

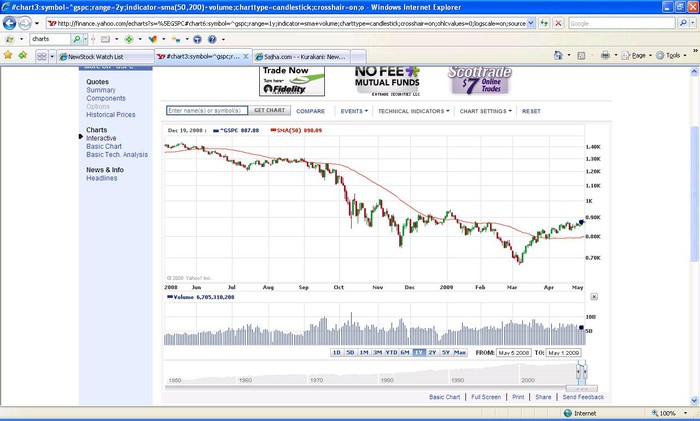

S&P500 2 year chart

|

| |

|

|

lato_boy

Please log in to subscribe to lato_boy's postings.

Posted on 05-04-09 5:32

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

emini - welcume back. and thanks for sharing some of your strategies/picks..

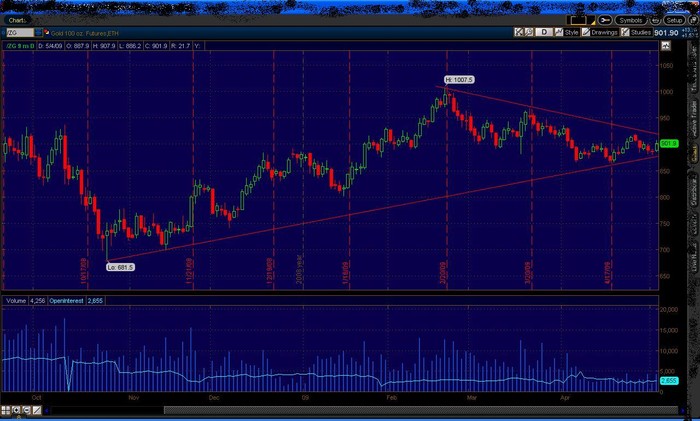

Personally i dont like this rally and i dont think rally has lot of potential beyond few months.. so i will advise people to stay away from C&H patterns.. for me the risk to reward ratio does not justify to be a Bull in a Bear Market.

however... look at the 6 month gold chart shows a breakout is imminent from current trading range.

|

| |

|

|

lato_boy

Please log in to subscribe to lato_boy's postings.

Posted on 05-04-09 5:50

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

here is the corrrect chart for gold.

|

| |

|

|

purush

Please log in to subscribe to purush's postings.

Posted on 05-05-09 1:48

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Just to keep this thread up in Sajha. We need it in the front. Good job Batho_Boy. U should change your nick dude.

|

| |

|

|

mi171a

Please log in to subscribe to mi171a's postings.

Posted on 05-05-09 7:41

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Hi Emini: You were talking about C&H and I am wondering now how do we get it and does it cost any money to analysize our tricker? mi171a

|

| |

|

|

Bricoloer

Please log in to subscribe to Bricoloer's postings.

Posted on 05-05-09 9:24

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Emini, great to see you back again. After a long while I stepped onto Sajha doorstep today to find that you are contributing again. Welcome back! Still holding DNDN for long. But with stop loss set. Remember the 4/29 fiasco. Still I have no clue what happend except that SEC said everything was fine. Gosh, we learn new things everyday. I am checking on some of the recommended ones from you. I still feel that the market is not fully up on its two legs. But definitely it is showing signs juss like my little one. Best! Bricoloer ps, latoboy, hello there. Also, hello to the rest of the Nepali Investors.

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 05-05-09 5:37

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

All our picks from last 2 weeks are doing good except for GLNG and AGYS. GLNG never got to our trigger price so no one should have bought it. AGYS did get to the trigger price and much higher but started selling off so I had suggested yesterday to get out of that. It went down today. I bought GTI this morning and added more FEED. I was away from my computer so I did not get a chance to post earlier. Current positions: PCX, STV, GTI and FEED.

|

| |