Hey emini, nice to see you here. Yeah, your threads did have strategy but as you put it, "people seemed more interested in stock picks than strategy", so I guess it was lacking a little in that particular dept I was looking for. However, I did get some very good tips from that thread. As most of the folks who visited their site, I've always appreciated your good work here.

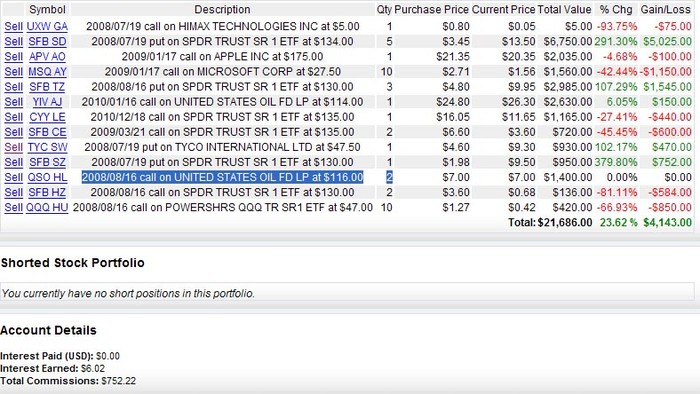

Moving from Market Making to Prop trading has indeed been an experience so far. I've now added trading the spreads mainly on the treasury futures and cash (trying to add to my FX forte) for the past 2 months and the RSIs have been working well in these spreads mainly beacuse these are range-bound markets...I assume stochastics too may work really well for the rangebound trades (as one of my co-workers uses that ONLY along with the moving averages and has been making a killing lately!!). Today I backtested the BBs (though not a fan of it) and didn't see it as successful as the other indicators were on these spreads at all. However, for trending markets, ever used the ADX along with the parabolics? It's pretty neat as the ADX I feel can give a good entry signal whereas the parabolics are perhaps the best indicators to jump outta a trade (as they're also a SAR signal). Trading these indicators along with a brief fundamental analysis every morning when the economic data comes out (8:30am EST) has really improved my previous method of using Fibonaccis with MACDs...very unconventional but it worked well in FX Spots but not in treasuries. However, as you said leverage in futures is the only drawback I feel can cut me dry as the institutional players in this market are huge and I've seen instances when these large players often create an artificial spike against the technicals to throw off the individual traders whose stops are triggered...After this, the market turns back to its original course. As per the Street, many are speculating the current rise in oil prices being pushed by the oil companies themselves. These companies have trillions at their disposal (more than all the major IBs and Banks combined) and could forcing a buy side bias and thats what their traders have been doing lately. Would hate to be in oil (long or short) right now...Hey, was talking to another trader today and he talked about spreading oil and wheat. Sounds like a good strategy as these markets have been correlated for the past few months now. I'll backtest that and will let you know what I feel on that.

Also for FX books, I read Cornelius Luca's Trading in the Global Currecy Markets a few years ago and it was the best I've ever read on FX. As for Options, haven't read much (mostly on the net) but Marcel Link's High Probability Trading was a great read and gave good insight for novies as well as the experienced pros. And on Treasuries, am currently reading the Treasury Bond Basis by Burghardt.

Anything on Risk Management? I feel that I have a lot to learn in that (the recent IB fiascos show how little that is taught here...LOLs).

Simple Life, thanks! If you're starting in this field, I recommend books like Dr. Elder's Trading For a Living and Mark Douglas' Trading in the Zone to get your mentality set like that of a trader. All the best and hope to hear of some of your strategies soon.